Fuel & Housing Costs are the highlight of the most recent CPI report

The U.S. Bureau of Labor Statistics released the newest CPI readings for February 2024

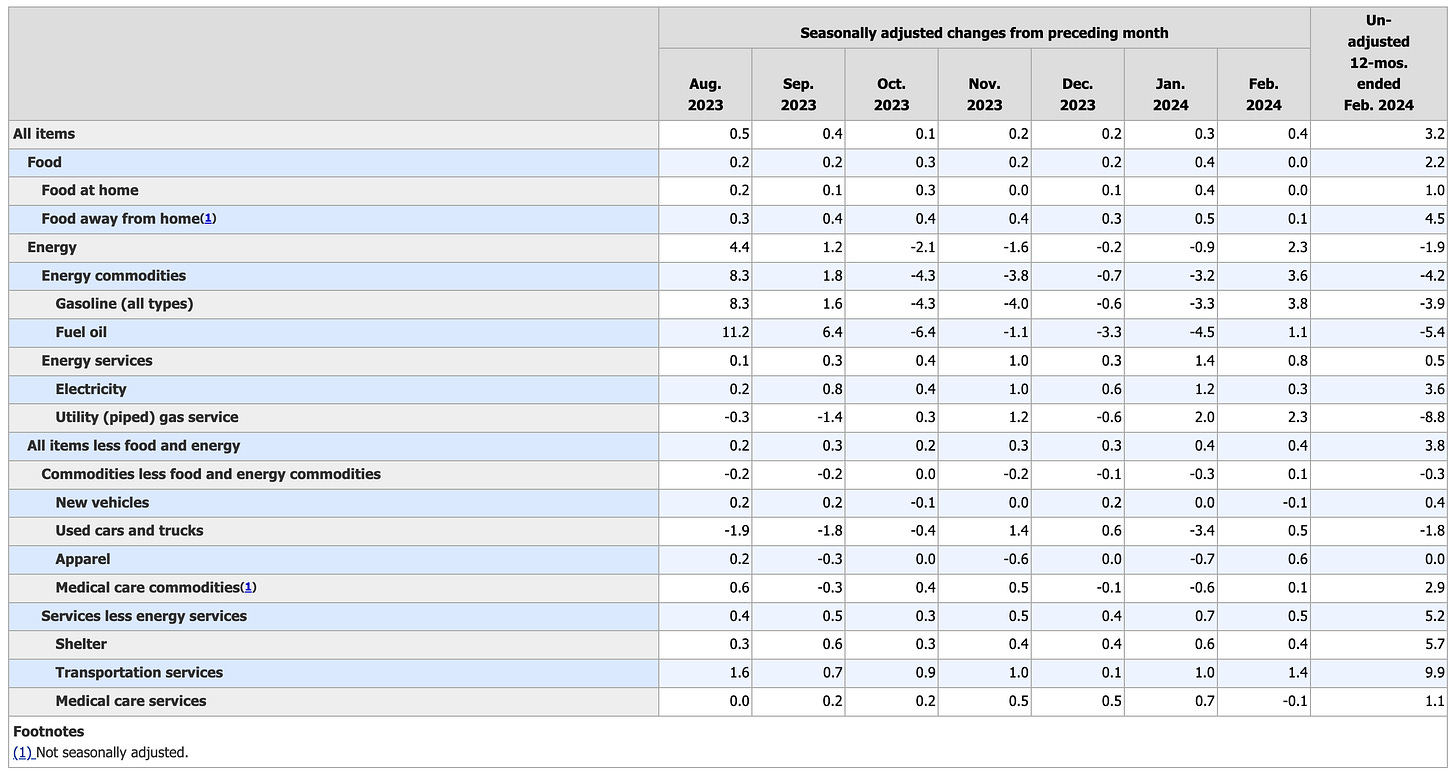

In the latest Consumer Price Index report for February 2024, we observed a nuanced yet impactful trend in consumer prices, particularly with a 0.4% increase from the previous month and a year-over-year inflation rate of 3.2%. For those of us keen on real estate and investing, these numbers are more than just figures; they're indicators of the broader economic landscape in which we operate, especially in the housing market.

The increase, primarily driven by higher shelter and gasoline costs, albeit with stable food prices, subtly hints at the cost pressures that consumers are facing. The 2.3% rise in the energy index alone could have ripple effects (see chart), influencing everything from the cost of living to the affordability of housing. This is particularly pertinent for real estate investors who rely on a stable economy to buoy property values and rental incomes.

The housing market, always sensitive to changes in consumer spending and inflation, could see shifts in demand, especially as the cost of borrowing may adjust with inflationary pressures. Higher mortgage rates could cool down some of the overheating markets, but they also pose challenges for buyers, potentially reducing purchasing power and affecting the investor market.

For investors, the current economic indicators suggest a time for cautious optimism. The stability in food prices, despite other increases, could mean that consumers have more resilience than anticipated, possibly maintaining their purchasing behaviors. However, the critical analysis should be applied when considering new investments or adjusting portfolios, as the market remains fluid and sensitive to both domestic and global economic shifts.

While the February CPI report presents a mixed bag, it's a crucial touchstone for us in the real estate sector. Understanding these economic undercurrents allows us to make informed decisions, whether we're looking at buying, selling, or holding properties. The key takeaway? Stay informed, adapt strategies as needed, and always keep an eye on the broader economic indicators that impact the real estate market. Think like the elites, you can make elite level choices.